Once a company is formed or registered in any state, there are many annual or periodic compliance obligations that must be met. Maintaining the existence of the company and authority to conduct business within each state is critical to an operating business.

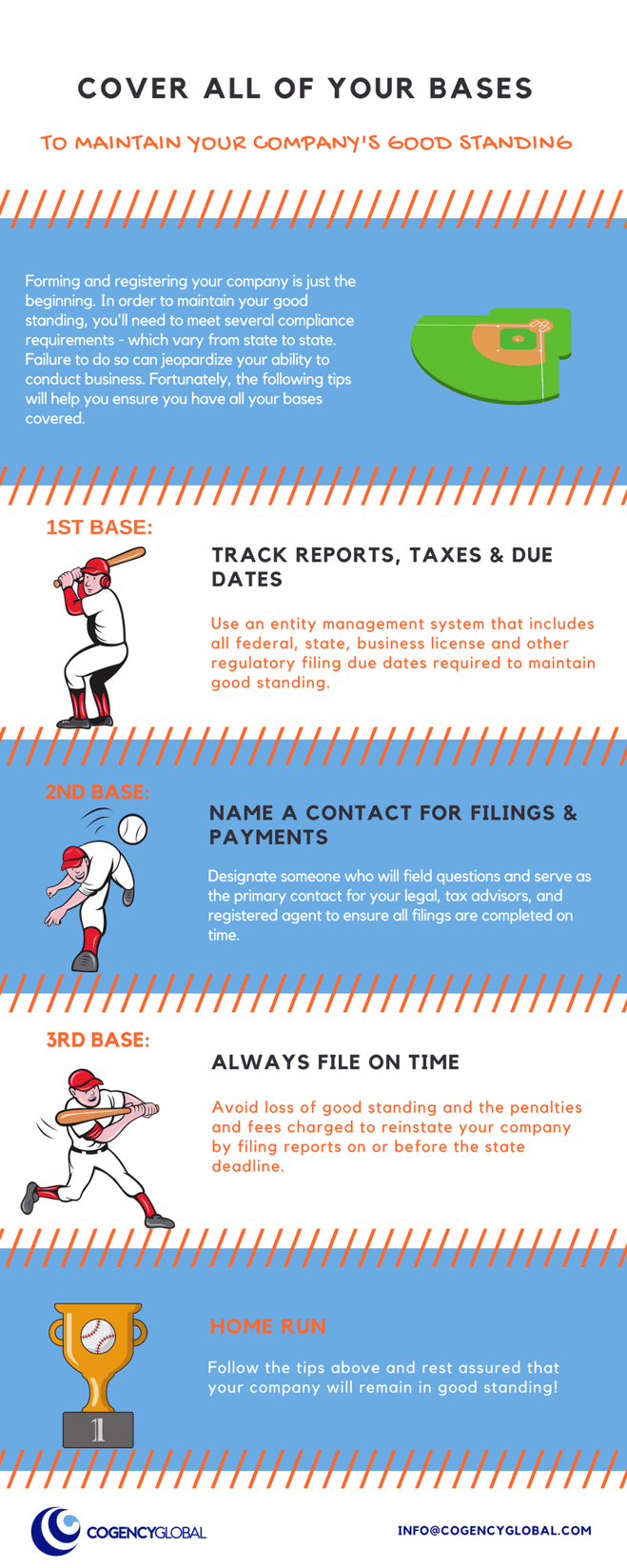

Keeping your company in good standing may seem simple, but requirements and terminology regarding what “good standing” actually means varies from state to state. Failure to maintain good standing status can jeopardize your right to conduct business, access to courts, limited liability status and can also delay closing financing transactions, in addition to other adverse consequences.

Being aware of some of the nuances and questions to ask is helpful to ensuring that you “cover all of your bases” when managing compliance for your business entities.

Missed filings can cause a company to lose good standing and, after a period of time, be revoked in a state. Penalties, interest and other fees are often charged to reinstate a company back in to good standing.

Many companies delegate the responsibility for handling different types of filings to multiple teams or advisors. Consider a point person who can field questions and be the main contact to ensure coordination among your legal and tax advisors, as well as your registered agent, to ensure that all filings and tax payments are being taken care of.

Also consider using an entity management system that includes the due dates of all filings required by the Secretary of State, federal and state income tax returns, business license filings, and any other regulatory filing that may trigger loss of good standing.

This content is provided for informational purposes only and should not be considered, or relied upon, as legal advice.